Introduction

A trading plan is the most important factor in determining trading success. A trading plan will help take your emotion out of trading – which will help you make better trades and make you a better trader.

Make sure your trading plan reflects you as a trader. In developing your trading plan, you should consider factors such as your trading style, your level of experience and your risk profile. And, of course, your trading plan should be customized to your personality.

One key reason for a trading plan is to ensure you also define your trading strategy completely before you trade – including determining the factors that will be used to measure success. Do not place any money in the market until you know exactly when you will enter, and then what your strategy is if the market goes up, goes down or goes sideways.

A trading plan will:

- Keep you disciplined

- Outline exactly what you want to trade

- Give you confidence in your trading decisions

Your trading plan should encompass every aspect of your trading ventures, including:

- When you will trade and your trading timeframe

- Markets you want to trade

- Risk and money management guidelines

- Your trading strategies – Entry and exit signals that you will use, as well as your stop loss

If you need help developing your plan, we’ve created a template that helps you develop your own. This is free – you only need sign up as a subscriber.

Read on to see how to create your own successful trading plan.

Step 1 – Define Goals

As you’re sitting down to develop your trading plan, the first step is to define your goals. Is there a particular reason you’ve decided to start trading? Do you have a financial goal, such as a down payment for a house or a new vehicle? Are you looking to grow your investments for use later, supplement your income or are you wanting to become a full time trader? Take note of your motivations and use them as a basis for your goal.

Your goals should always be realistic. A realistic goal will help keep you focused with a date and clear timeline. Make sure to follow the SMART methodology with your goals; ensure that they are specific, measurable, attainable, reasonable, and timely.

Then, from there, think about your specific trading timeframe and what returns you want to achieve. This is not the final step, however. To keep your goals effective, you need to review and update them every so often as needed.

Step 2 – Set up your Trading Business

No matter whether you’re a beginner or an expert, looking at your trading as a business will help you stay disciplined. A simple shift in mindset can make a world of difference when it comes to achieving your goals. A business mindset can keep you disciplined as you execute on your trading strategies.

It’s also important to understand your own skill level. If you are a beginner, be aware of that and set your goals accordingly – this goes back to setting realistic, SMART goals. It’s also a good idea to identify your own weaknesses – such as gaps in your own knowledge and experience, and how you plan to fill these gaps. If you are new to trading, it is better to start with less complex trading strategies and less volatile markets.

Next, do an inventory of your trading resources. How much capital do you have? How much are you willing to invest? How much experience do you have? How much time will you devote to trading?

Step 3 – Define your Trading Style

Your trading style will be defined by a combination of your risk tolerance and skill set. It is dependent on your personality, strengths, the amount of time you have to trade, and your goals. Take a broad look at each individual component before you decide your trading style.

Ask yourself these questions. Do you want to trade short term or long term? Are you going to take a technical analysis or a fundamental approach? Do you prefer slow or fast moving markets? What is your risk profile? It is the combination of your skill level, risk profile and trading resources that will help you define your trading style.

Step 5 – Risk and Money Management

Risk is an inherent part of trading and needs to be carefully managed. By setting a maximum loss per trade, and sticking to it with a stop loss, you can specify your risk on every trade and minimize your losses.

An understanding of money management will help you calculate the risk per trade, based on your account size. For example, say you set a risk threshold of 10% of your total capital. This doesn’t sound all that high. However, a risk of 10% of total capital on each trade would mean that you can only have 10 losing trades in a row before your entire capital is lost. However, if you set the risk threshold at a 2% risk level, you would have to have 50 losing trades in a row to lose it all. So although 50 losing trades in a row is very unlikely with a sound trading strategy, you can see that it is a much better risk level to protecting your capital over the long term.

Apply your risk tolerance level to each trade before you place your trade and ensure that you have a stop loss in place to effectively manage that risk. It’s important to understand how to implement your risk level to each trade. Doing so will allow you to determine your position size based on your risk level, entry, and stop loss points.

Step 6 – Trading Strategies

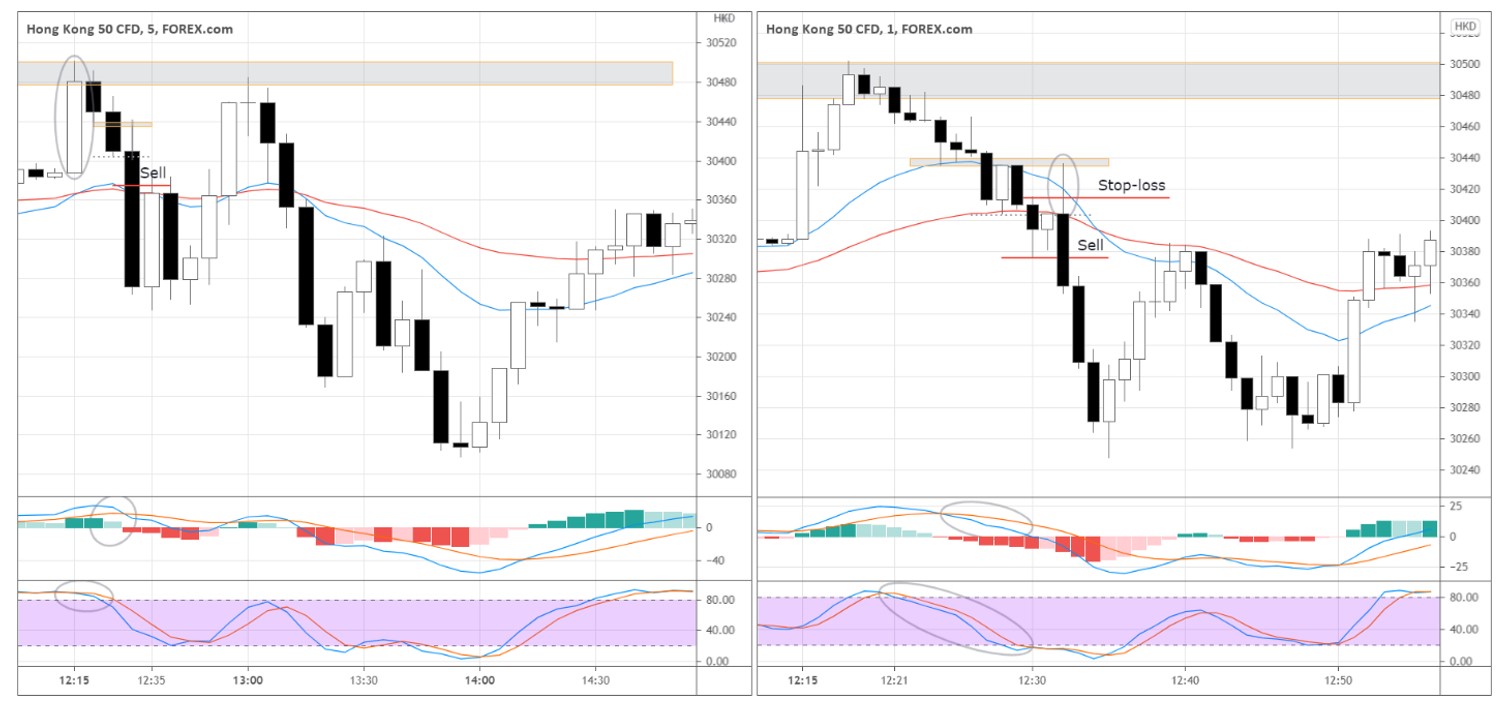

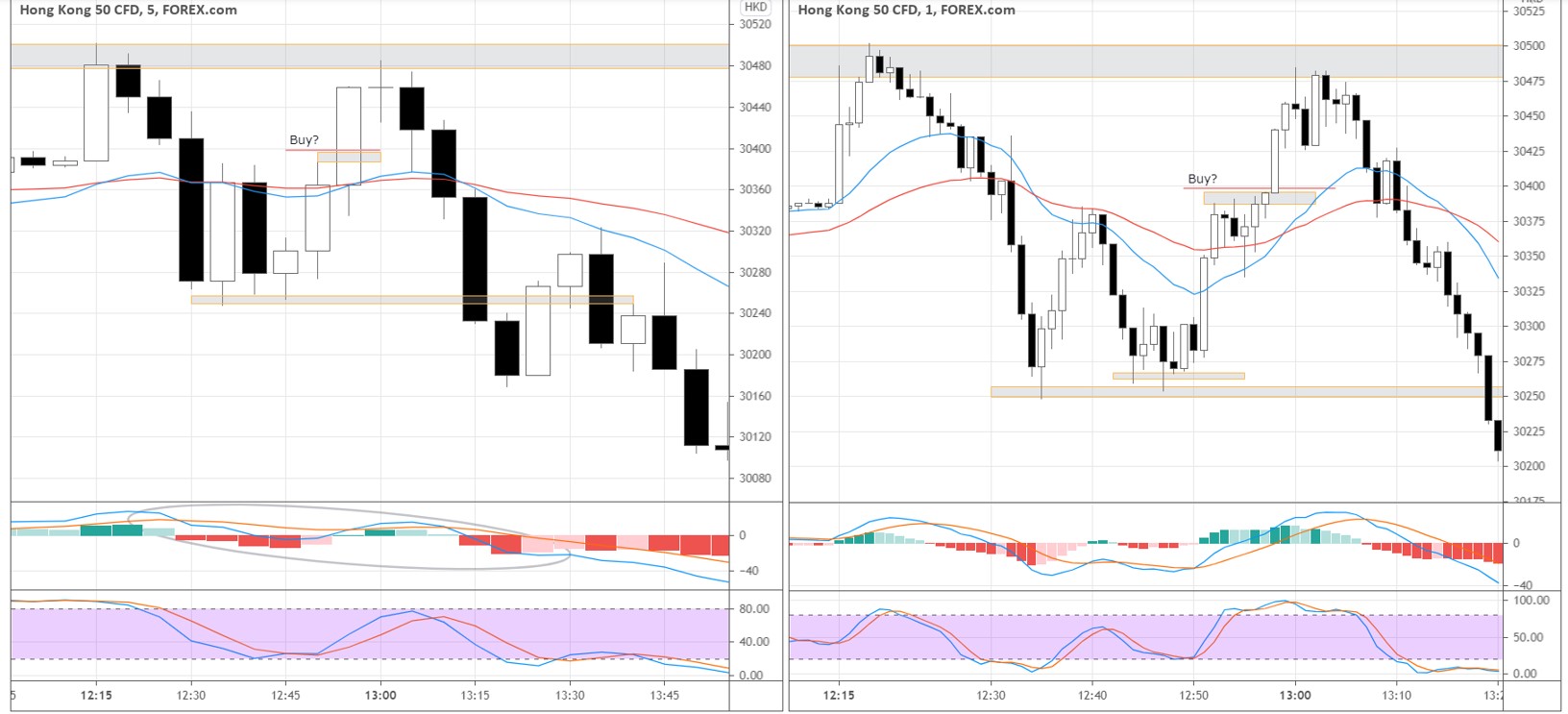

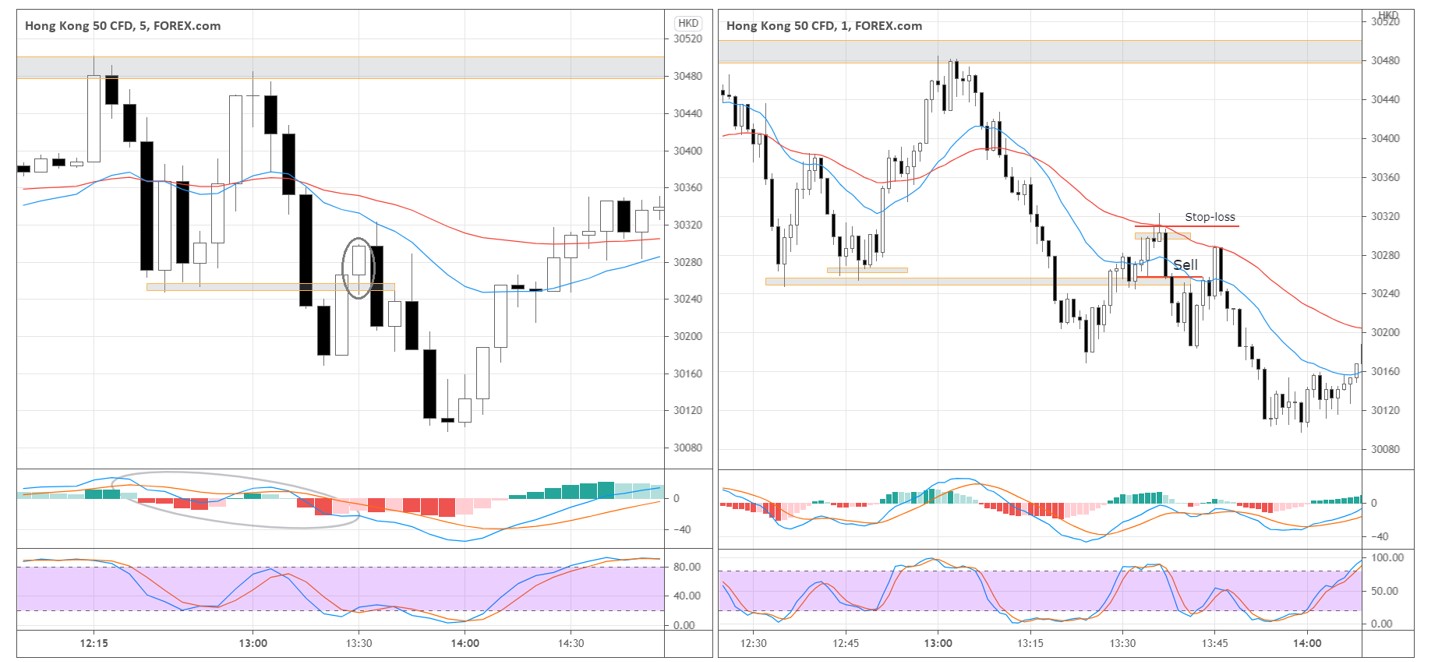

A trading strategy defines your execution. It sets the rules for your desired setups, your entry trigger, and where you place your stop loss. It also helps you decide when to exit and determines which indicators you will use to support your analysis. Your trading strategy should be clearly defined before you trade.

Setting rules for any price action that occurs while you’re trading will help you decide your next move and how to execute your trades. These rules will allow you to trade based on rules you’ve set instead of with emotion. No matter what happens- whether the price rises, falls, or goes flat- you’ll have rules for action.

Step 7 – Record and review

A trading plan is only useful if you track your progress. While it may sound strange at first, it’s a good idea to keep track of the trades you make in a spreadsheet or journal. A trading journal can also help you calculate key statistics, such as hit ratio and edge ratio, which will help you understand how to improve.

List the stock name, the price, why you chose that trade, and whether you earned money on it or not. By reviewing these trading logs, you’ll be able to understand why you made the decision you did. You can review your thought patterns for error as well as see when you were correct in your predictions. These logs can also highlight recurring patterns – whether positive or negative.

Hindsight, as they say, is 20/20. More than that, hindsight is one of the most powerful educators in existence. Having a detailed document to review will let you accelerate your learning by identifying patterns. Identifying where you can improve is key in not only making but keeping your money.

Conclusion

There are several essential steps when it comes to a successful trading plan. You must first define your goals- before you even set up your trading business. After you’ve set up your trading business, you’ll need to keep stock of your own skill and knowledge- which you’ll use to define your trading style. Then, you’ll need to determine your risk tolerance and how you’ll manage your money. Next, you’ll need to set up your trading strategies and trading journal. Finally, to achieve the best results, you’ll need to record and review.

However, completing these essential steps will assist in trading success. By following the above steps, you’ll already be ahead of many other beginning investors. You are now better equipped than ever for trading success.